Continuum on South Beach 50 S Pointe Dr

The daily average high in Miami is 76 degrees, so spending lockdown in here is a lot more of a pleasure, than, for example, in places like Chicago.

Add to that an open economy, relatively low COVID cases count, fewer masking requirements, stable politics and no income tax and you would think that this real estate boom could’ve been predicted. But, nobody did. Besides that, Florida’s realtors and developers also have learned to be careful of the bubbles since they remember how it was before.

Although, this time we have all the signs that the current boom will stay here for a while, as the country’s other major cities like Manhattan and San Francisco struggle with long-term re-pricing in other directions.

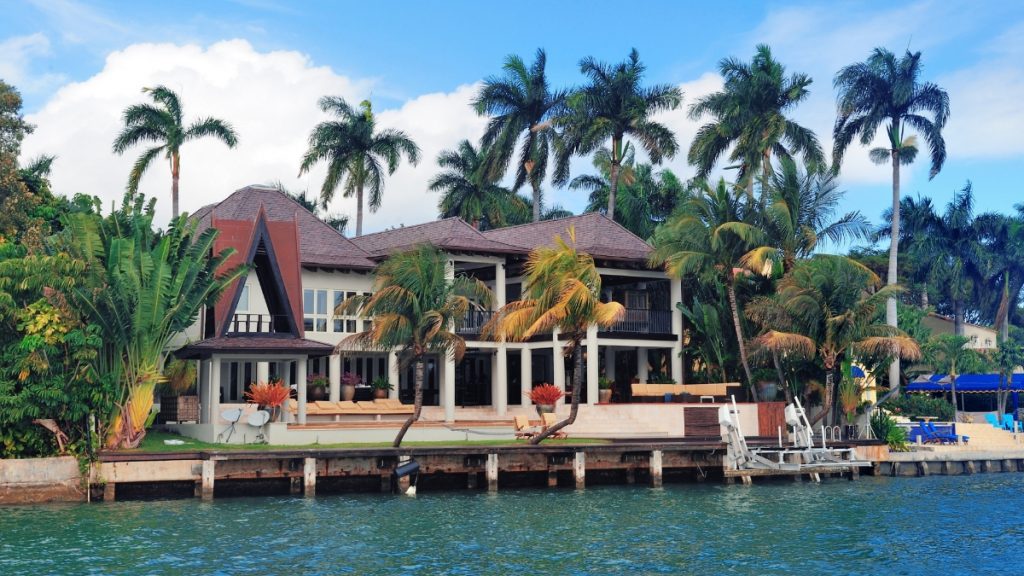

Examples of top-tier sales over the past eight months, including many celebrities, goes on and on. Ivanka Trump and Jared Kushner recently purchased a $31,000,000 waterfront plot on Indian Creek, which also features 13 private police and a marina guard, and not too far from Tom Brady and Giselle Bundchen’s new $17,000,000 digs. Besides that, Julio Iglesias, Carl Icahn, Adriana Lima and Jeff Soffer too reside on the island.

But, we cannot ignore the real estate data. No matter how cynical one might be about the 1% vortex that South Floria is becoming.

ONE Sotheby’s recently released January 2021 Market Report is riddled with statistics that realtors and developers would have scoffed at as recently as a year ago.

Average for-sale prices for single-family homes in South Florida’s four main counties skyrocketed year-over-year – Miami-Dade (42%+), Palm Beach (20%+), Martin (20%+), and Broward (12,5%). And it goes even further – we can see an increase in sales of homes over $3,000,000 for seven consecutive months, 17% of all single-family homes across all price levels closed in January sold above list.

A similar situation we can see in the report that was made by RelatedISG. Total active single-family home listings in Miami-Dade, Broward, and Palm Beach hit a 12-year record low at the on of the past year. Never-seen 9000 homes on the market across all price ranges, in comparison with 20,000+ in 2015.

You can say, that South Florida’s boom is circumstantial, which historically makes a lot of people nervous because circumstances in highly elastic real estate change all the time in the markets like Miami. The pandemic just happened when we have record-low mortgage rates, a lot of remote work, and many people that are looking to buy up or down. And here we go, boom!

And it was inevitable. Anyone who’s lived here for some time will confirm that. It just happened to be accelerated by COVID-19. Most out-of-town buyers were already moving to South Florida from high housing costs, high taxes, high-density states like New Your, New Jersey, Illinois seeking lower cost of living, way better weather and healthier quality of life. And not they are coming like an avalanche, with cash and for good.

The biggest question on most people’s minds at this point is how long the current boom will last.

“The US Federal tax reform act of 2017 will be the main driver if what we’re seeing right now continues,” said Craig Studnicky, RelatedISG’s CEO and President. “There’s a reasonable argument that Trump punished certain “Blue” states, like NJ, NY, Connecticut, Massachusetts, Illinois, and California, which resulted in a mass exodus to places like South Florida. Then COVID-19 acted as an accelerator in 2020. The pandemic will eventually pass, which likely will slow down the pace of in-migration. But unless the tax reform act of 2017 is repealed, this boom is sustainable as long as the underlying tax expense and planning incentives are in play.”

It’s very beneficial not just for South Florida’s real estate market and developers, but also for the region’s economy. At this point in-migration into Florida shows little sign of ebbing, and financial firms like Goldman Sachs, Blackstone, Citadel, and Elliott Management as well as several venture capital firms are reportedly not far behind. At the same time housing inventory has nowhere to go but down. New ground-up condo and developments take years to launch, design, and build. So, in the interim, prices have nowhere else to go but up.

It is really good to be a real estate agent in South Florida.

And you better to hurry up to get in, while you can.

Based on Forbes Material by Peter Lane Taylor